Centre For Global Political Economy

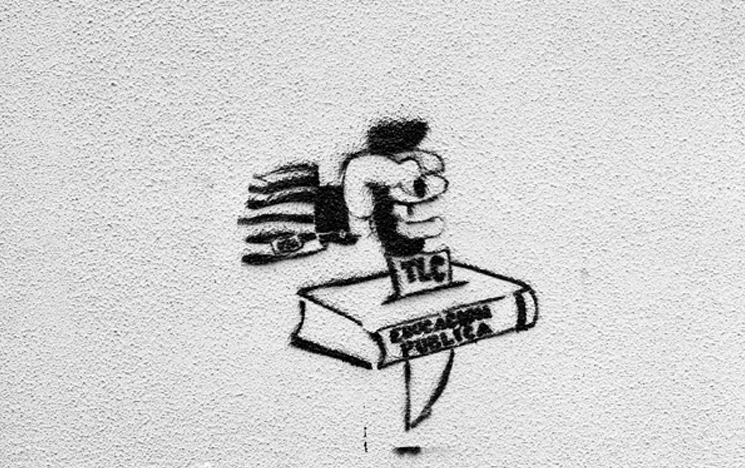

The Centre for Global Political Economy is a vibrant community of scholars from an array of disciplines, united by a concern with how global capitalism generates diverse patterns of wealth, dispossession, and ecological devastation, and how these dynamics are resisted by communities and social movements.

Alongside new empirical research on contemporary issues, our members are developing theoretical and conceptual tools and categories that are able to capture and analyse the actors, processes, structures and historical dynamics of contemporary global political economy, and are involved in various collaborative ventures with social movements, campaigners and policy-makers.

Contact

If you have a query or would like to contact us email cgpe@sussex.ac.uk.